Mwanga-Hakika Bank unveils loan programme for MSMEs

In its quest to support financial inclusion through innovative services, Mwanga Hakika Bank has unveiled the new loan service for the marginalized micro and small business owners.

With Mwanga Hakika bank, customers will conveniently acquire loans using simple collaterals that align with the nature of business.

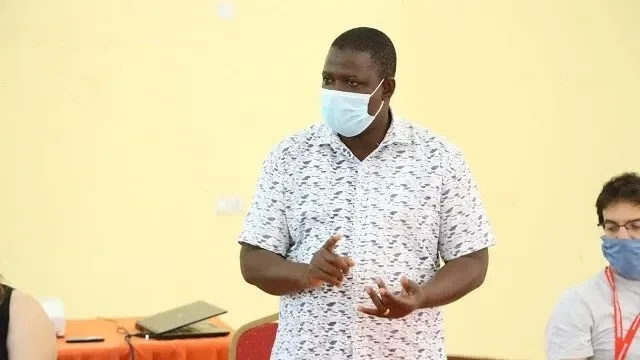

Speaking during the launch, Head of Retail Banking at Mwanga Hakika Mwinyimkuu Ngalima said the bank is determined to support the growth of both Micro, Small and Medium (MSEMs) and large businesses through providing tailor-made solutions that align with their needs.

“We are delighted to bring this new service to the market, and we believe it is going to enhance our service delivery to small business owners. We are confident that this market segment remains potential for economic growth hence they need to be provided with services that align with their needs and business nature,” he said.

“Arguably, for a person to acquire a loan, you need to have collaterals like legal equity or machinery which has been a major challenge to small business owners who do not posses such properties denying access to formal financial services,” he said.

The new service provides a rare opportunity to small scale entrepreneurs /micro enterprises like boda-boda, bajaji, tax drivers and food vendors ‘Mamalishe’ to acquire loans with friendly requirements and affordable charges.

“We are inviting all entrepreneurs regardless of business nature to utilize this opportunity which provides wings to grow business by boosting your working capital,” he marked.

In Tanzania, MSMEs constitute more than three million enterprises and contribute more than 27 percent of the country's GDP.

Besides, MSMEs are vital in achieving a wide range of the Sustainable Development Goals (SDGs).

With Fursa Loan, a customer can simply acquire loan through a nearest branch and submit application which is processed within shorter period.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED