Revenues reaching 15.6 pc of GDP needs structural reforms

EARLY 20th century Russian revolutionary leader Vladimir Lenin once said that shame was a revolutionary sentiment.

He said that when employers start noticing that workers or the lowest rungs are very thin and begin to worry about it, there would already be change in the air.

This was to suggest that people would start to understand when there are demands for improved conditions for the working class, a model of ethical awareness that could be applied in many other situations.

Something of that sort is being noticed here, with top officials in the government feeling that the country is collecting much lower taxes than the continental average, and by significant gaps, from 15.6 per cent to 12 per cent.

The natural reflex in those quarters is to start working on a review of applicable tax legislation so that revenue collection is raised to an average of 15.6 per cent of the Gross Domestic Product (GDP), which has already been reached by many African countries.

When Vice President Dr Philip Mpango made this observation, there was a parameter he didn’t immediately address: that many of the countries doing better in revenue to GDP ratio don’t exactly compare with us in terms of natural resources.

In other words, we ought to be collecting an even greater percentage than most of those doing better than what we are.

Trouble is that in an experts’ gathering, as was the case Dar es Salaam venue where the matter was raised, it is a matter of tax laws and what that implies for revenue collection levels.

This may be somewhat inward looking if one compares some data, for instance a September 22, 2023 online write-up to the effect that taxes collected by the central government in Kenya came to nearly 15.9 per cent of the neighbouring country’s GDP in 2019.

Another datum, citing World Bank development indicators and entered in nearly the same environment and dated July 5, 2017, said that tax revenue (per cent of GDP) in Kenya was reported at 14.3 per cent in 2020.

Despite clear efforts to do better, all reference to reviewing tax laws to significantly improve collection levels will be directed at raising the rates and instituting sharp enforcement for compliance.

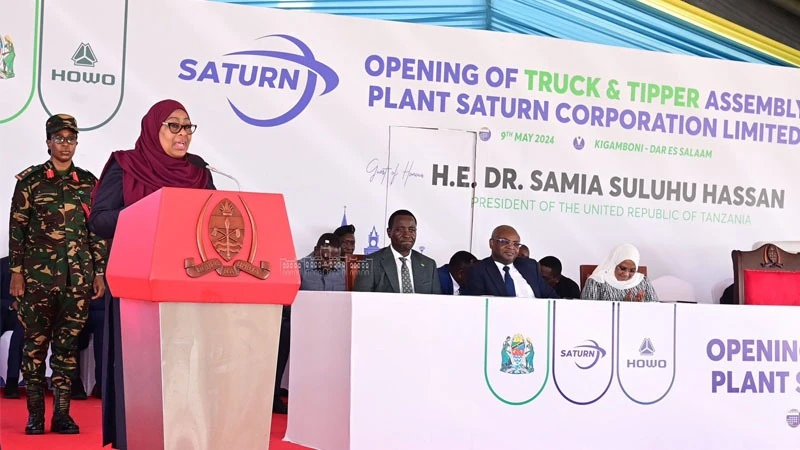

That is exactly that the Samia Suluhu Hassan government has laboured to obliterate over the past three years.

Presumably, some watchdogs are making efforts to call the government to attention: that we are slipping up in tax collection and are significantly below the sub-Saharan average.

That would inform and fortify our aggressive approach to taxes, at times possibly at the expense of methods found to have proved effective in investment drives elsewhere.

What needs to be said regarding the tax law reform idea as to raising revenue collection levels by GDP is that the Kenyan example shows that it isn’t due to high taxes or harsh tax laws that they collect significantly higher revenues than we do.

While population levels are in our favour, with us boasting 11 million more people by 2022 census data, our total budget is usually around 60 per cent of theirs, while we have 63 per cent more territory than Kenya.

We thus have far greater resources to exploit and raise more substantial revenues, with critics suggesting that we cannot do it since the economy is dominated by the public sector, a form of restriction.

Bravo, TAHA for landing export pact for three horticultural crops

AGRO-SECTOR policy makers and top bureaucrats must have toasted right to the wee hours on learning that the Tanzania Horticultural Association (TAHA) recently landed a deal for regular placement of orders for three varieties of local crop produce.

Reports said that the key sub-sector institution dispatched a delegation of growers and exporters to the Fruit Logistica trade show in Berlin, where the Frankfurt-based Daily Green Co. placed the orders.

The German firm has since then sent officials to our northern tourism capital, Arusha, to seal an export deal with specific plants or growers – under the auspices of TAHA. There was hope of obtaining substantial quantities of okra, bitter gourd and African bird’s eye chili.

The buyer placed an order for 2,340 tonnes of okra per annum, to see farmers earn 3.51bn/-, alongside 2,880 tonnes of bitter gourd and 520 tonnes of African bird’s eye chili. This comes to a total of 4.32bn/- and 780m/- in earnings, respectively.

But while all that is rosy, a stern test will likely be experienced later following this success, as TAHA’s marketing blitz at Fruit Logistica 2024 also attracted the attention of five potential investors.

These declared interest in investing in Tanzania’s horticultural sub-sector, whereas accessing land for farming could pose problems.

It is, of course, possible for TAHA to still succeed in facilitating the implementation of the projects if it doesn’t let investors follow the usual channel of obtaining land from the Tanzania Investment Centre (TIC), but this could also prove a challenge.

What could best be done is that TIC and TAHA point at the relevant areas and then investors, with TAHA as witness, pay out the local people with claims to the land or, in some cases, using it.

The idea that the lion’s share of the new business opportunities would be directed at women and youth implies that credit is almost entirely set in that direction, when it is arranged by TAHA.

However, with improved pieces of land occupancy legislation in place complete with titles enhanced from customary law to freehold ownership, the banks would easily lend for crops with assured markets.

That would serve in the place of excessive reliance on targeted credit facilities from this or that development partner.

This source of credit was evident when TAHA expressed appreciation to its key partners, including the Tanzanian government, the Swedish Embassy in Tanzania, the World Food Programme and the Tanzania Agricultural Development Bank for the massive support that enabled the association to take part in Fruit Logistica 2024.

Credit easily comes in as part of empowerment arrangements as a whole, boosting its outreach capacity, etc.

This stage of baby-sitting the horticultural industry will likely come to an end when land laws are improved to make it easier for banks to lend to farmers.

It is clear that nearly all farmers look at specialised banks like TADB as the key resource they hold is not transferable to another person. Accordingly, plenty of marking time could be lying in wait.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED